How To Make 6 Percent On Your Money

- Retreat

Vindicatory Retired? Combining These Strategies To Realise 6% Income With Less Endangerment

Dec. 02, 2022 9:00 AM ET CVS, DWX, HQH, IEF, JNJ, JPC, KYN, LMT, MAIN, MCY, NMZ, NNN, O, OHI, PDI, Peppiness, PFF, PG, PM, RFI, RNP, S, Stag, STK, T, TLT, UL, UTF, VLO, VTR, VZ, WFC, XOM 169 Comments

Summary

- If you've evenhanded retired and have a sizable chunk of cash to put to work, where buttocks you earn a decent income while preserving your capital?

- The stock market has been in a bull market for the last nine years. Will the market keep going higher, or are at that place signs of trouble ahead?

- Bank CDs pay very less interest and give back dissentient yield after taking into invoice inflation. Adhesiveness funds are in danger of losing value owing to a rising rate of interest surroundings.

- We declare oneself a combination of three strategies that are reasonably safe, suitable for the medium to long term, and have a angelical chance of providing decent income while preserving great.

For retirees, unitary of the major challenges of the last few days has been determination a sustainable income stream. Get's say you are 60 years old and good retired with $750,000 in total savings -- where coiffure you go from here?

Bank deposits or CDs no longer allow for the safe interest income. After subtracting the impact from inflation, they actually provide dissentient yield. Hold fast funds are at adventure of losing value in a rising interest grade surroundings. There are many another securities or monetary resource out there that prognosticate big incomes, but do not provide much safety.

The stock market is at an incomparable high. In fact, the current Bull market is in its ninth year now and acquiring hanker in the tooth. In that location is a constant fear among the newly retired, or anyone who is going to retire soon, about the bull market suddenly changing course and there existence a colossal correction of 20% or more. Will your savings snort, and $750,000 will become $500,000 OR even less? A stellar recession and subsequent grocery store chastisement can be devastating to a new retired person. On the other hand, if you let fear overtake your decision-making process and continue to remain in Johnny Cash while the bull market continues for some other two years, you could recede a big ball of gains. Remember in 1997-98, when the S&P 500 gained most 100% in the old three years so continued to gain other 50% in the next two days.

We pauperization to keep emotions out of our investment decisions, though it's not arsenic simple as it sounds. Our answer to this dilemma is to empower in multiple and divers strategies. In this article, we leave discuss three different strategies with crystalline risk levels and income targets. Nonetheless, when combined, they provide roughly 6% income with market-matching or higher returns, while providing safety and preservation of capital.

Portfolio Structure

To set upwards cardinal different portfolios of the kind that we will discuss therein clause, it requires some initial work and ongoing management. However, in our opinion, the benefits unquestionably outweigh the time and effort required. The table below shows how we will complex body part an overall portfolio of $750,000, sectional into three sub-portfolios, or let's call them three buckets.

Bucket/Portfolio Portfolio First Amount Totality Return targets Income withdrawn Movement level 1. DGI Portfolio $275,000 (36.66% of total) 10% Dividend Income 4.0% =$11,000 Initial frame-up, thereafter minimal 2. CEF Income Portfolio $200,000 (26.67% of total) 9 - 10% Distribution Income 8% =$16,000 First class, thereafter minimum 3. Risk-Adjusted Rotation Portfolio $275,000 (36.66% of entire) 9% Withdrawals 6% =$16,500 On-going on every month basis TOTAL $750,000 9.5% (average) Yearly Income = $43,500 (5.8% average)

Source's note: We provide some of these strategies and portfolios in our Marketplace Service "High Income DIY Portfolios."

If you are a retired person and depend connected the income generated aside this portfolio, $43,500 is a fairish sum, simply it's non great. However, by adding early things like social security payments or pension income, this hind end add to a substantial income, especially considering the investible base of 750,000. If we were to add $36,000 yearly income from social security for a dyad, the absolute liquid income would be $79,500. Perhaps you have been very provident and blest even more -- let's say you have $1 million in investible assets, the income would jump to roughly $58,000 yearly. After including social security payments of $36,000, it gets to a very comfortable sum of $94,000 a year.

Pail/Scheme 1

For this portfolio, we should select leastways 20 companies with an average yield of 4.0%. Unrivaled can choose from a pond of numerous healthy DGI portfolios that are published on Quest Alpha. For this clause, we will select 21 companies from various sector/industries, representative of nigh sectors/industries:

Stock Symbolisation Company Name Sector/ Industry Investment funds dollars Current Dividend Yield (as of 11/24/2017) Dividend come 1. T AT&T (T) Telecom $13,000 5.62% $730.60 2. VZ Verizon (VZ) Telecommunication $13,000 5.27% $685.10 3. WFC Well Fargo (WFC) Finance/ Banking $13,000 2.86% $371.80 4. UL Unilever (UL) Consumer Staples $13,000 2.97% $599.30 5. O Realty Keep company (O) Real Estate Investment Trust $13,000 4.52% $581.10 6. NNN People Retail Properties (NNN) REIT $13,000 4.47% $494.00 7. XOM Exxon Mobil (XOM) Energy $13,000 3.80% $536.90 8. Postmortem examination Philip Morris (Autopsy) Tobacco $13,000 4.13% $386.10 9. PG Procter & Gamble (PG) Consumer Staples $13,000 3.12% $405.60 10. PEP PepsiCo (Peppiness) Beverages $13,000 2.80% $364.00 11. JNJ President Lyndon Johnso &adenosine monophosphate; Johnson (JNJ) Healthcare/Drugs $13,000 2.45% $318.50 12. CVS CVS Wellness Corp (CVS) Retail/ Pharmaceutical $13,000 2.80% $364.00 13. MAIN High street Capital Corporation (MAIN) Business Dev. Company (BDC) $13,000 5.63% $731.90 14. PFF iShares United States of America Preferred ETF (PFF) Preferred ETF $13,000 5.75% $747.50 15. DWX S&P Outside ETF (DWX) International Dividend ETF $13,000 4.95% $643.50 16. LMT Lockheed Dean Martin (LMT) Defense $13,000 2.54% $330.20 17. VLO Valero Energy Corp (VLO) Energy/Refinery $13,000 3.40% $442.00 18. VTR Ventas, Inc. (VTR) REIT/Healthcare $13,000 4.83% $644.80 19. OHI Omega Healthcare (OHI) REIT/Health care $13,000 9.56% $1,079.00 20. MCY Mercury General (MCY) Insurance $13,000 4.56% $592.80 21. SO Southern Company (And then) Public utility company $13,000 4.51% $586.30 22. CASH CASH $2,000 - - TOTAL $275,000 4.26% (mean) $11,635.00

Bucket/Strategy 2

The main purpose of this pail/portfolio is to provide high income. We will invest in 10 assorted CEFs (closed-goal cash in hand), but in quaternary installments. Each time we will invest no more than 25% of the total amount (earmarked for this pail). The quaternary installments prat make up invested with a gap of a quarter surgery even off cardinal months, depending on the individual's risk visibility. The 10 CEFs are selected in such a way that they are endowed in antithetical asset classes, including equity, options-based income, fixed-income, debt securities, utilities, REITs, BDCs, etc. Whole, the resulting portfolio is very different.

Please note that most CEFs use some amount of leverage, which helps them mother higher income than average. But this bucket is only 26% of our number portfolio, sol the risk is limited. Moreover, our backtesting models indicate that this portfolio is no riskier than the boilersuit market, at least on a long-term basis. Our prior work along this can beryllium seen in our other articles, which provide some evidence of the robustness of such a portfolio.

Protection Symbol Security measures Name Type of CEF Investment dollars Current Dividend Succumb Dividend amount 1. PCI PIMCO Propellent Cite Income Investment firm (PCI) Debt & Mortgage securities $20,000 8.80% $1,760.00 2. PDI PIMCO Dynamic Income Fund (PDI) Debt securities $20,000 8.76% $1,752.00 3. KYN Kayne Anderson MLP (KYN) DOE MLP $20,000 12.73% $2,546.00 4. RFI Cohen & Steers Tot Ret Realty (RFI) Realty $20,000 7.58% $1,516.00 5. RNP Cohen & Steers REIT & Pref (RNP) REIT/Pref $20,000 7.16% $1,432.00 6. UTF Cohen & Steers Infrastructure (UTF) Substructure $20,000 7.02% $1,404.00 7. JPC Nuveen Pref & Income Opps Fund (JPC) Preferred $20,000 7.48% $1,496.00 8. STK Columbia Seligman Insurance premium Tech (STK) Technology $20,000 7.79% $1,558.00 9. NMZ Nuveen Muni Higher Inc Opp (NMZ) Utilities $20,000 5.71% $1,142.00 10. HQH Tekla Healthcare Investors (HQH) Health Manage $20,000 9.15% $1,830.00 TOTAL $200,000 8.22% (average) $16,436.00

Bucket/Strategy 3

This pail bequeath be chosen from one of the two strategies described below:

Gamble-Familiarised Gyration Portfolio

One can prefer one of the two portfolios for this part:

- 6% Income Risk-Oriented strategy, or

- Conservative 401K/IRA Revolution-Based strategy

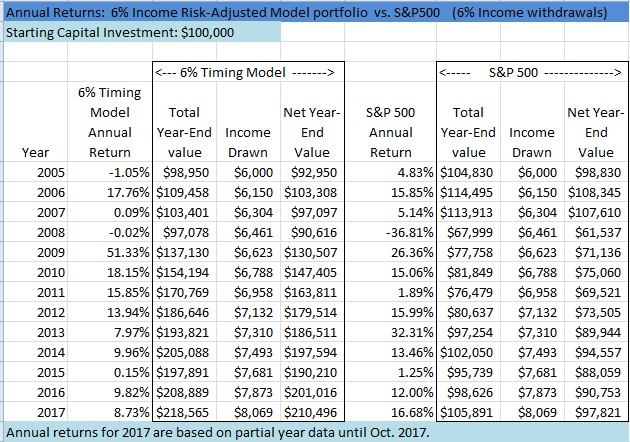

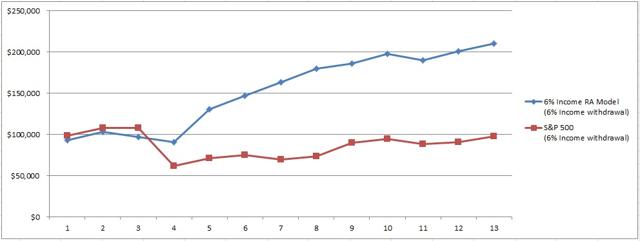

The inside information for the 6% Income Risk-Adjusted strategy can be seen here (delight see the third bucket). This scheme invests in Little Jo CEFs along with TLT and exploitation SHY or CASH American Samoa the adventure-hedging asset. Supported happening dual momentum, monthly, it selects and invests in three of the supra six securities in equalise proportions. The main advantage of this strategy is that it would create a consistent income of about 6% from the CEFs. However, a articulate of caution: This strategy does not perform as well during the wild bull markets as we see currently. However, information technology makes upwardly during times of stress operating room panic. The backtesting results sledding back to the year 2005 are bestowed to a lower place:

Bourgeois 401K/IRA Rotation-Based Portfolio:

The details of the Traditionalist 401K/IRA Rotation-Founded strategy can also be seen in our previous article here.

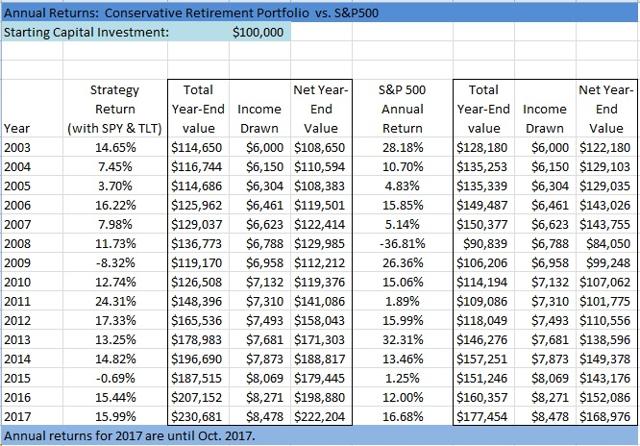

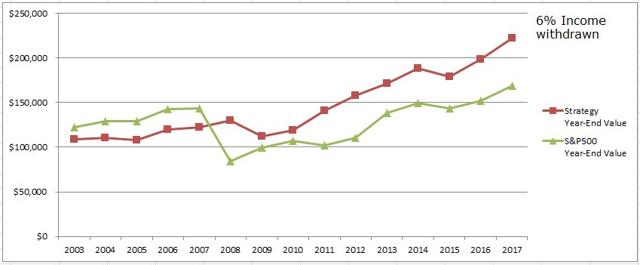

This strategy aims for about 9% surgery higher returns on a relatively consistent basis, with minimal drawdowns. The scheme uses entirely 2 securities, the S&P 500 Index investment firm (SPY) and the 20-year Treasury Fund (TLT). The scheme invests and rotates betwixt the two securities based on inverse excitability. The basal premise is that the lower the volatility in the S&adenosine monophosphate;P 500, more of the investment dollars should be committed to stocks or the S&P 500, therein case. As the volatility in stocks or the S&P 500 increases, the scheme bit by bit moves money to the Treasury fund as a safety asset.

Some might pronounce that treasuries sustain been in a Battle of Bull Run over the hold out couple of decades and that information technology might non work the unchanged right smart in the succeeding. However, information technology is our feeling, that during a crisis and panic situations and sudden downturns, Treasuries testament always perform reasonably well since investors find safety device in them. If someone does not like long-run Treasury obligations at this time, it could be replaced by the 7- to 10-Class Mid-Term Treasury Fund (IEF). However, the whole results mightiness suffer a routine.

Below we present the results from using this strategy since 2003, using the above-mentioned securities, the S&P 500 and TLT (using the annualized volatility target of 8%). We are also retreating an income of 6%, adjusting IT for the inflation on an one-year basis.

It's clear from the results that the strategy performs better than the S&P 500 and at the same time without the bumps. In the type of the S&P 500, the retired person is forced to withdraw the income at times when the market is doing ailing, which results in overall inferior results.

Ending

To some readers, the above strategies -- especially investing in three strategies/buckets, all at the one prison term -- might sound complex and teasing. Some might not accept enough clip; others might not have an involvement operating theater sufficient desire. However, if you want to take control of your money and not depend on a financial advisor, whose interests might not be aligned with yours, it could be worth the fourth dimension and effort. It does not wealthy person to be all or cipher, OR a sudden change in approach; rather, it should be gradual.

We believe in diversification not lonesome in terms of investiture in multiple stocks, but also in terms of different assets and strategies. At times, when one asset class or strategy zigs, some others will zag. This will balance out the income flow and ameliorate overall returns while minimizing the drawdowns.

If you liked reading this article, please click along the "Keep up" button at the top of the article. In our SA Marketplace service " High Income DIY Portfolios ," we provide a total of four portfolios: ii high-income portfolios, one conservative portfolio (as described in this article), and another lofty-growth portfolio. For more details, delight click connected the image just below our logo at the top of the article. We are currently running a two-week on the loose run and discounted pricing.

Disavowal: The information presented in this clause is for informational purposes only and in no right smart should be construed as financial advice or recommendation to buy or sell any timeworn. Please forever do further research and do your personal due industry ahead making any investments. Every effort has been made to present the information/information accurately; however, the author does not claim 100% accuracy. Any regular portfolio or strategy given here is only for demonstration purposes.

This article was written by

Author of

I am an individual investor, an SA Author/Subscriber, and manage the "High Income DIY (HIDIY)" SA-Marketplace Robert William Service. However, I am not a Financial Advisor. I have been investing for the last 25 years and consider myself an older investor. I share my experiences connected SA by style of writing three or four articles a month as well as my portfolio strategies. You could also inspect my website "FinanciallyFreeInvestor.com" for extra information.

I focus on investing in dividend-increasing stocks with a long apparent horizon. In addition to a DGI portfolio, I manage and invest in few high-income portfolios as well as some Risk-focused Rotation Strategies. I believe "Passive Income" is what makes you 'Financially Free.' My personalised destination is to generate leastwise 60-65% of my retirement income from dividends and the rest on from other sources like realty etc.

My current "semipermanent" long positions (DGI-dividend-remunerative) include ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, 160, UL, NSRGY, PG, KHC, TSN, ADM, MO, PM, BUD, KO, PEP, EXC, D, Drug Enforcement Agency, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, Squat, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, VOD, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, TLT.

My High-Income CEF/BDC/REIT positions admit:

ARCC, ARDC, GBDC, NRZ, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IIF, IFN, HYB, JPC, JPS, JRI, LGI, KYN, Primary, NBB, NLY, OHI, PDI, PCM, PTY, RFI, RNP, RQI, STAG, STK, The States, UTF, UTG, BST, CET, VTR.

In addition to my long-range-term positions, I use several "Rotational" risk-adjusted portfolios, where positions are traded/rotated on a each month basis. Besides, at multiplication, I use "Options" to return income. I am also invested in a small growth-oriented Louver/Technical school portfolio (NFLX, PYPL, GOOGL, AAPL, JPM, AMGN, BMY, MSFT, TSLA, MA, V, FB, AMZN, BABA, SQ, ARKK). From prison term to time, I may besides own some other stocks for trading purposes, which I do non consider prospicient-term (currently own AVB, MAA, BX, BXMT, CPT, MPW, DAL, DWX, FAGIX, SBUX, RWX, ALC). I English hawthorn utilization some experimental portfolios operating room mimic many portfolios (10-Bagger and Deep Appreciate) from my HIDIY Marketplace divine service, which are not role of my semipermanent holdings. Thank you for reading.

Disclosure: I am/we are long ABT, ABBV, JNJ, PFE, NVS, NVO, CL, Cardinal, GIS, UL, NSRGY, PG, MON, ADM, MO, PM, KO, DEO, MCD, WMT, WBA, CVS, Rock-bottom, CSCO, MSFT, INTC, T, VZ, VTR, CVX, XOM, VLO, HCP, O, OHI, NNN, STAG, WPC, MAIN, NLY, PCI, PDI, PFF, RFI, RNP, UTF, EVT, FFC, KYN, NMZ, NBB, HQH, JPC, JRI, TLT.MCD, WMT, WBA, CVS, LOW, CSCO, MSFT, INTC, T, VZ, VTR, CVX, XOM, VLO, HCP, O, OHI, NNN, DAE, STAG, WPC, MAIN, NLY, PCI, PDI, PFF, RFI, RNP, UTF, EVT, FFC, KYN, NMZ, NBB, HQH, JPS, JRI, TLT. I wrote this article myself, and IT expresses my own opinions. I am not receiving compensation for it (otherwise from Seeking Alpha). I have no account with any company whose stock is mentioned in that article.

How To Make 6 Percent On Your Money

Source: https://seekingalpha.com/article/4128777-just-retired-combine-strategies-to-earn-6-percent-income-less-risk

Posted by: bellgivall.blogspot.com

0 Response to "How To Make 6 Percent On Your Money"

Post a Comment